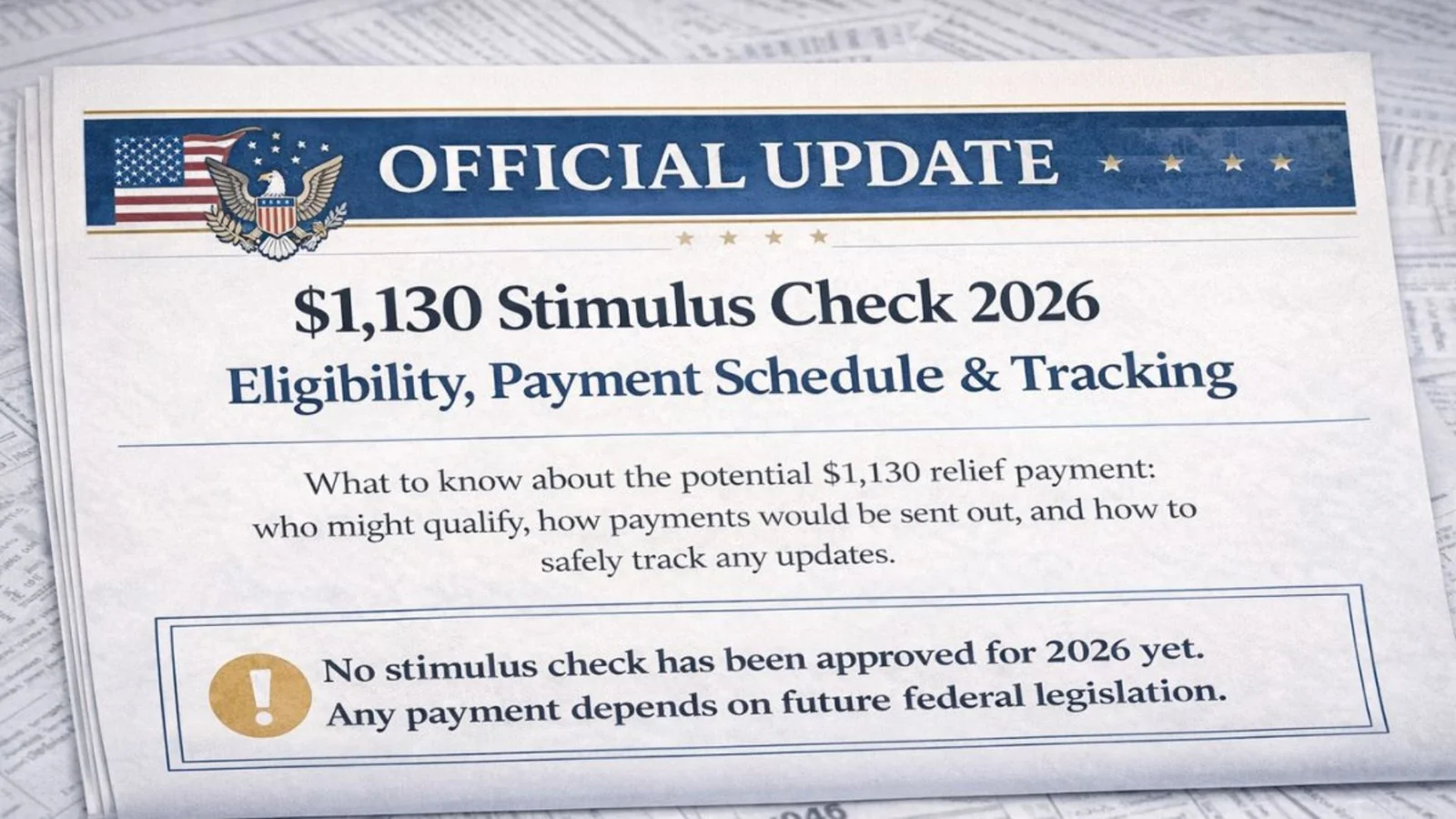

Reports about a possible $2000 IRS direct deposit in February 2026 have been widely shared online. Many people are wondering whether a new stimulus payment has been approved and when the money will arrive. However, based on official updates, there is no nationwide $2000 federal payment scheduled for February 2026. Any deposits close to that amount are most likely regular tax refunds.

No Official $2000 Stimulus Has Been Approved

At this time, Congress has not passed any law authorizing a blanket $2000 stimulus payment. The IRS cannot issue a nationwide relief payment without formal legislation. If you receive around $2000 during February, it is likely connected to your 2025 federal tax return rather than a new government program. It is important to separate verified information from online rumors.

Why Some Refunds May Be Around $2000

Many taxpayers receive refunds near or above $2000 each year. This usually happens when a person had more tax withheld than necessary or qualifies for refundable credits. Credits such as the Earned Income Tax Credit or the Child Tax Credit can significantly increase a refund amount. Because refunds are based on personal income, filing status, and dependents, two people with similar earnings may receive very different totals.

Expected IRS Refund Timeline for 2026

The IRS generally begins accepting returns in late January. Taxpayers who file electronically and choose direct deposit often receive refunds within about three weeks, provided there are no errors. Returns that include certain refundable credits may be held until mid-February due to fraud prevention rules. Paper returns typically take longer to process and may extend into March or later.

Factors That Affect Refund Amount and Timing

Refund totals depend on several factors, including adjusted gross income, filing status, total taxes withheld, and eligibility for credits. In some cases, outstanding federal or state debts can reduce a refund through offset programs. Delays may also occur due to identity verification checks, mismatched income information, or incorrect banking details. Filing electronically and reviewing all information carefully can help avoid problems.

How to Prepare for Filing Season

To ensure a smooth refund process, taxpayers should gather all income documents before filing. Double-checking Social Security numbers, dependent details, and bank account information can prevent delays. Using direct deposit remains the fastest and safest way to receive a refund. The official IRS tracking tool can be used to monitor the progress of a filed return.

There is no confirmed $2000 IRS stimulus payment for February 2026. Most deposits around that amount are standard tax refunds based on individual tax filings. Refund amounts and timing vary from person to person, depending on income and credits claimed. Staying informed through official IRS sources is the best way to avoid confusion and manage expectations.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Tax laws and payment schedules may change. For the most accurate guidance, consult official IRS resources or a qualified tax professional.