$2,000 IRS Direct Deposit in February 2026: As February 2026 approaches, many people are seeing online posts claiming that the Internal Revenue Service has approved a $2,000 direct deposit for everyone. These messages are spreading quickly through social media and text messages. For families facing high costs for food, rent, and utilities, the idea of extra financial help sounds very appealing. However, it is important to carefully review the facts before believing or sharing these claims.

At this time, there is no official confirmation of a nationwide $2,000 payment for all Americans. No federal agency has announced such a program.

No Law Has Approved a Universal $2,000 Payment

For the federal government to issue a large payment to the public, a formal legal process must take place. Congress must pass a bill explaining who qualifies, how much will be paid, and how the program will be funded. The President must then sign that bill into law. Only after these steps can the IRS begin sending payments.

As of February 2026, no such law has been passed. There has been no official press release or public notice confirming a universal $2,000 direct deposit. Without legislation, the IRS does not have the authority to create a new nationwide payment program.

Why These Claims Spread During Tax Season

These rumors often appear at the beginning of the year when tax season starts. Millions of taxpayers file their returns in January and February. Once returns are accepted and processed, refunds begin reaching bank accounts. Many people who file electronically and choose direct deposit receive refunds within a few weeks.

For a large number of households, refund amounts are close to $2,000. When someone shares a screenshot of a deposit around that amount, it can easily be misunderstood as a new federal payment. In reality, these deposits are regular tax refunds, not stimulus checks.

How Tax Refunds Actually Work

A tax refund is issued when a person has paid more federal income tax during the year than they owed. This can happen if too much tax was withheld from paychecks or if the taxpayer qualifies for credits related to children, education, or earned income. Each return is calculated individually based on income and personal details.

Refund amounts vary from one person to another. The $2,000 figure appears often simply because it is a common refund range for many working families. It is not evidence of a new government program.

The Importance of Checking Official Sources

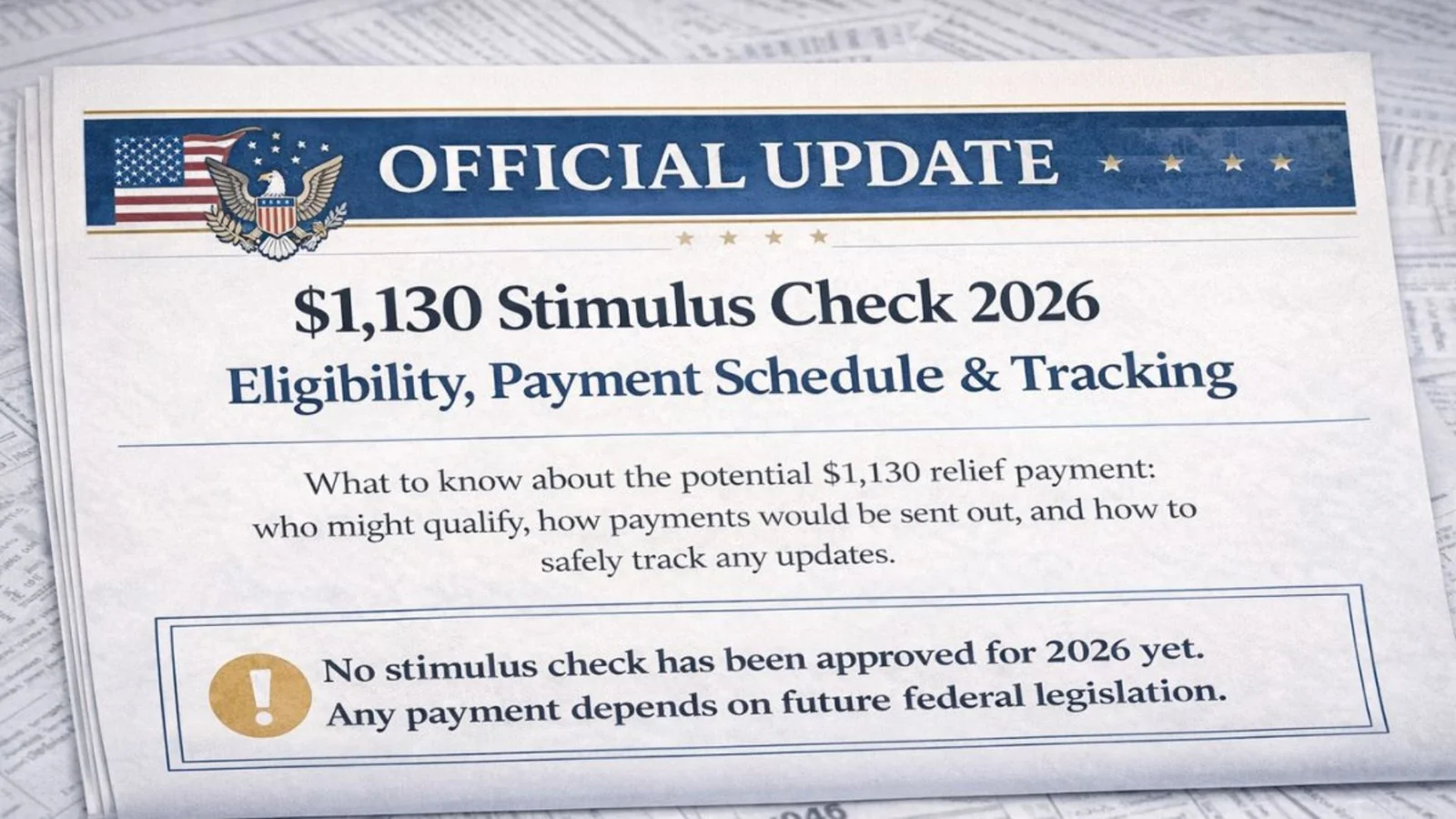

Relying on unverified online posts can lead to confusion and poor financial decisions. Official federal payments are always announced through trusted government channels. If a new relief program were approved, there would be clear public guidance explaining eligibility and payment dates.

There is currently no approved or confirmed $2,000 IRS direct deposit for all Americans in February 2026. Deposits around that amount are likely regular tax refunds based on individual filings. Checking official sources remains the safest way to stay informed.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. As of February 2026, no nationwide $2,000 IRS direct deposit has been officially approved. Refund amounts and timelines depend on individual tax situations and official IRS rules. For personalized guidance, consult official IRS resources or a qualified tax professional.