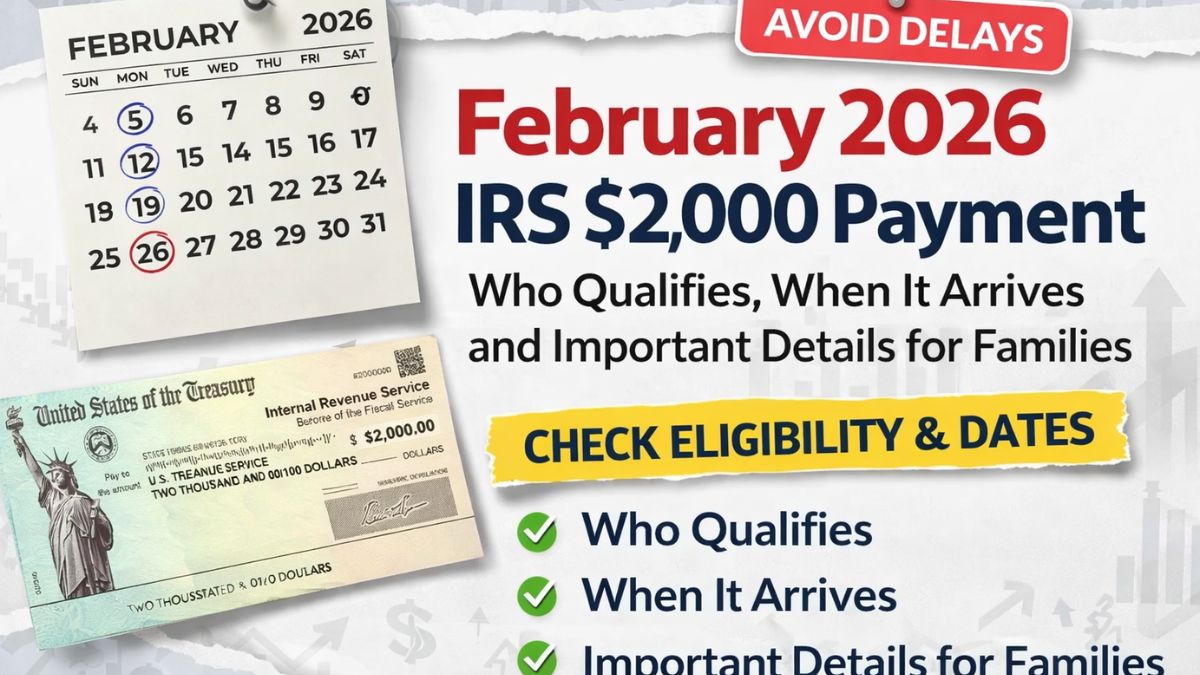

IRS Confirms $2,000 Direct Deposit for All: For millions of Americans, the final week of February 2026 brings renewed attention to a confirmed $2,000 direct deposit. With living costs remaining high, many households are watching closely for updates. According to official information, the payment distribution process is scheduled to begin on February 27, 2026, offering potential relief to eligible recipients.

At a time when families are balancing rent, groceries, loan payments, and medical bills, this payment is more than a routine deposit. For many, it represents breathing room in a tight monthly budget and the ability to move forward with greater confidence.

Why the $2,000 Payment Matters

A single $2,000 payment can make a noticeable difference. For renters, it may cover a month’s housing cost. Retirees may use it for medications or utility bills. Working families could reduce credit card debt or start building emergency savings. In today’s economic climate, even one well-timed payment can ease financial pressure.

यह भी पढ़े:

February 2026 IRS $2,000 Payment — Who Qualifies, When It Arrives and Important Details for Families

February 2026 IRS $2,000 Payment — Who Qualifies, When It Arrives and Important Details for Families

Beyond the dollar amount, the payment carries emotional value. It provides reassurance that support is available during challenging times.

Payment Timeline and Processing

The Internal Revenue Service has indicated that processing will begin on February 27, 2026. However, not everyone will receive funds on the same day. Direct deposits for individuals with updated banking details are expected to move first. Most eligible recipients may see funds arrive within a few business days in early March.

Those without direct deposit information on file may receive payments by paper check or prepaid debit card. These methods generally take longer, often extending into mid or late March. Direct deposit remains the fastest option.

Who May Be Eligible

Eligibility depends on income limits, filing status, and federal benefit participation. Individuals who recently filed tax returns are typically considered first, as their records are current. Low- and middle-income earners often qualify for full or partial payments depending on income thresholds.

Retirees and disability beneficiaries may also be included under program guidelines. Households with dependents could receive additional consideration. Updated tax and banking information plays an important role in smooth payment delivery.

Steps to Avoid Delays

Eligible individuals should confirm that their latest tax return has been filed and that bank account details remain accurate. If mailing addresses have changed, updating them promptly can prevent processing delays. Monitoring official announcements helps reduce confusion and avoid scams.

The $2,000 direct deposit beginning February 27, 2026, offers financial support at a time when many Americans need it most. While eligibility rules apply, staying informed and maintaining accurate records can help ensure timely delivery. For many households, this payment represents not just financial assistance, but renewed stability and hope.

Disclaimer: This article is for informational purposes only and does not constitute tax or financial advice. Eligibility, payment timing, and distribution methods depend on official government guidelines and individual circumstances. Readers should verify details through authorized IRS sources.