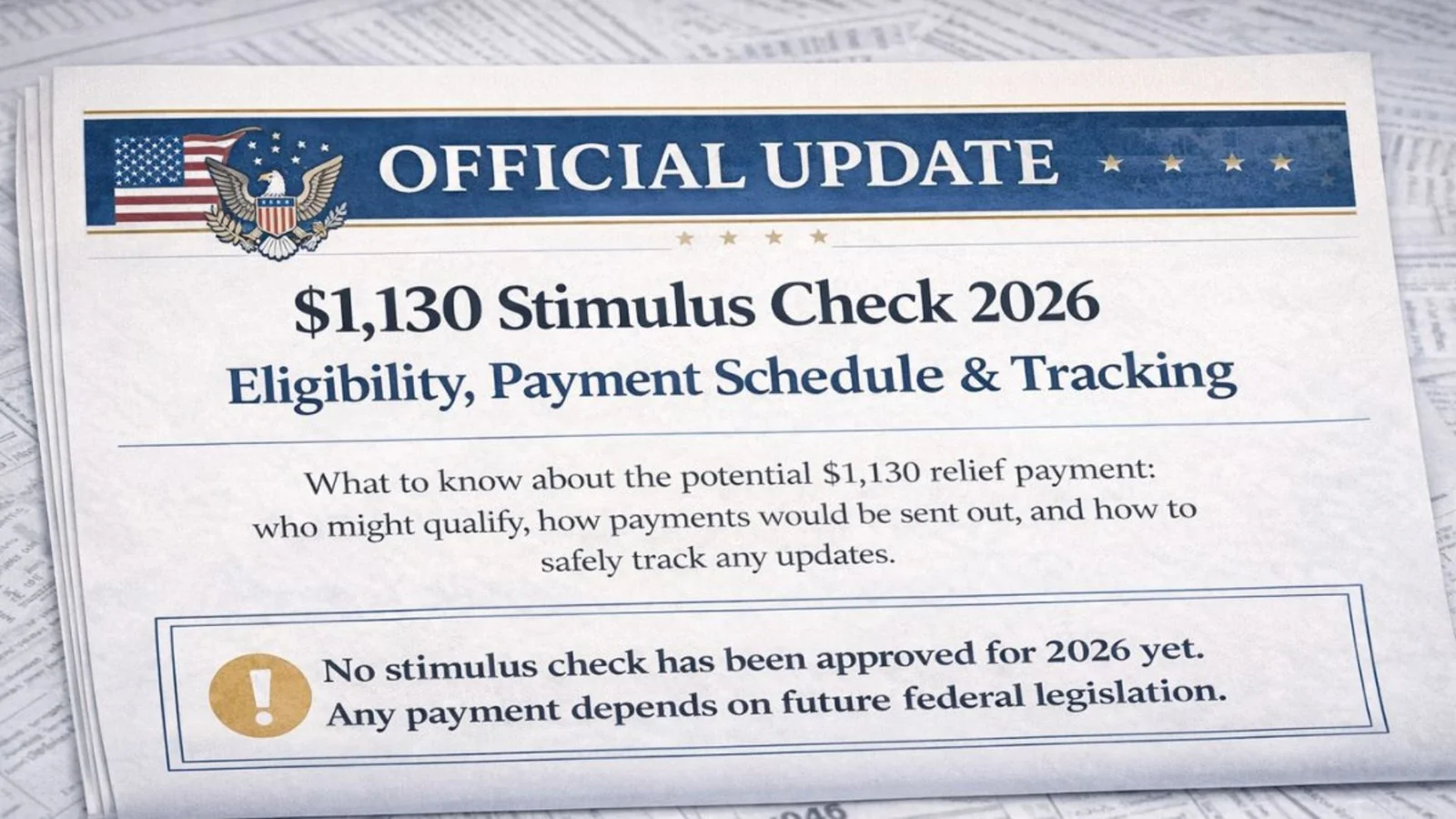

No New Stimulus Law Has Been Passed

At this time, no law has been approved that authorizes a universal $2,000 payment. Federal stimulus programs require Congress to pass legislation and the President to sign it into law. Only after that can the IRS distribute payments. The IRS does not create new nationwide payment programs on its own. Since no such legislation has been enacted, there is no official stimulus deposit scheduled.

Why February Deposits Cause Confusion

The 2026 tax filing season began in late January. Taxpayers who file electronically and choose direct deposit often receive refunds within two to three weeks after their return is accepted. For many families, refund amounts can exceed $2,000, especially when refundable credits are included. When these deposits arrive in February, they may look similar to past stimulus payments. In reality, these funds are regular tax refunds based on individual tax returns.

How Refund Eligibility Actually Works

There is no separate application for a $2,000 February payment because no standalone program exists. Refund amounts are calculated using details from each taxpayer’s return. Filing status, adjusted gross income, total tax withheld, and refundable credits all affect the final amount. Two people with similar incomes may receive very different refunds depending on their personal situation. A valid Social Security number and accurate information are required for proper processing.

Processing Times and Verification

Most electronic refunds are issued within about 21 days of acceptance, provided there are no errors. Paper returns take longer due to manual processing. Some returns may be reviewed more closely, especially when certain credits are claimed or identity verification is needed. Even after the IRS sends a payment, banks may take a few extra business days to post it.

There is no confirmed universal $2,000 direct deposit for February 2026. Any payment received during this period is most likely part of a standard tax refund. Refund amounts and timing depend on personal tax details and IRS processing procedures. Checking official IRS tools is the safest way to track your refund.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. As of February 2026, no nationwide $2,000 IRS direct deposit has been officially approved. Refund amounts and timelines vary based on individual tax records and IRS rules. Always consult official IRS sources or a qualified professional for accurate and updated guidance.